Imagine Facebook by itself becomes bigger than TV or newspapers. If anyone had predicted this 10 years ago, they’d have been laughed off.

If you think Facebook messed with your cheese in 2016, wait until you see what happens this year.

Now the social media giant is planning to become a local advertising powerhouse, faster than Google’s growth in the early 2000s.

Here’s a peek at some data points uncovered over the past few weeks:

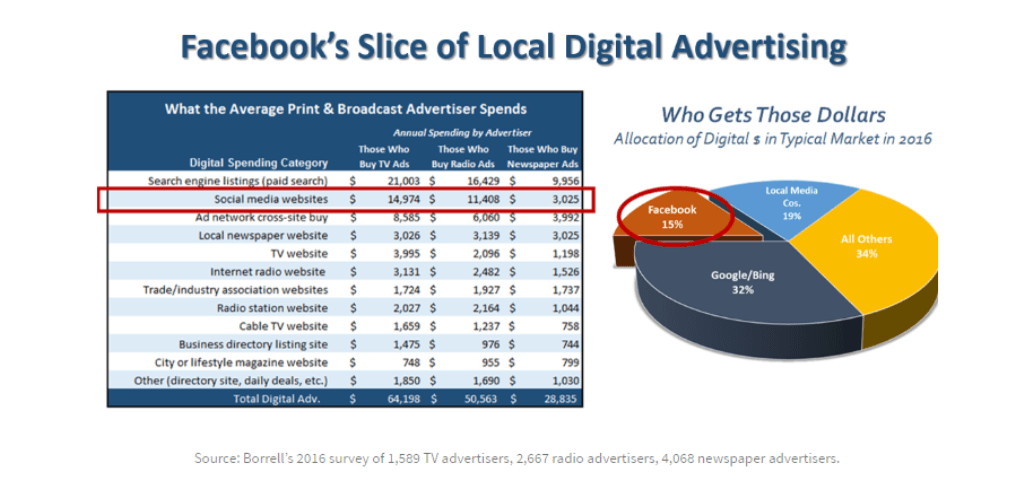

- In 2016, Facebook accounted for 15% share of the local digital pie and a 7.4% share of all local advertising.

- About $9.7 billion of Facebook’s estimated $13 billion U.S. ad revenue last year came from local businesses, or SMBs. That makes it bigger than local radio in terms of advertising dollars.

- Two-thirds of local businesses are spending money on Facebook. The average expenditure was $2,500 in 2016. This year, we estimate it will be at least $3,500.

- Spending is greater among those who also buy broadcast and print media (see chart). Social media spending – mostly on Facebook – was already in the $3,000 to $15,000-a-year range per advertiser last year. We think it will be $4,400 to 30,000 per advertiser this year.

- It’s safe to assume 35% to 40% growth in Facebook advertising this year with the addition of Instagram, Dynamic Ads, and the monetization of Messenger. If that happens, Facebook’s local-market take will likely be bigger than that of TV or newspapers.

How will media companies respond to this phenomenon?

We can expect three things: that managers will see Facebook as a competitor and work against it; that they’ll become paralyzed and respond with hand-wringing; or that they’ll view it only as an opportunity to drive traffic to their own content. All would be mistakes.

Also Read: Facebook Live Audio Introduced

A handful of media companies are doing none of that nonsense. The Local Media Association, which has become Facebook’s chief liaison with the industry. These companies have uncovered ways to generate significant revenue – in some cases in the millions – by working with Facebook.

So, how it all Happen? A quick Recap

When Facebook decided to go public in 2012, the plan was actually to boost mobile revenue via adverts in users’ newsfeeds. Cautious about putting people of using the app, it promised one ad per user per day.

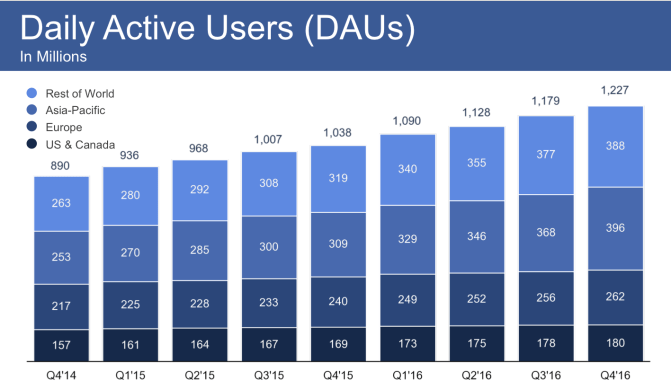

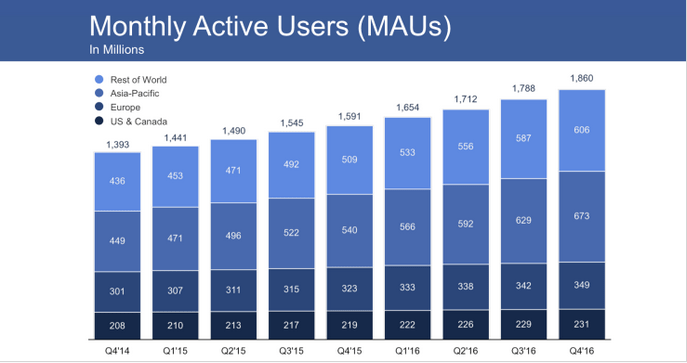

But, the end of 2016 the news feed plan has paid off. Mobile contributed 84% of revenue, accounting for $7.248bn which itself grew 51% to 8.8bn, resulting the net income of $3.5bn for the 4th quarter. Now, Facebook has 1.9bn users, 1.2bn logging on every day. From this it’s clear that Facebook has successfully completed its shift to mobile.

But, the end of 2016 the news feed plan has paid off. Mobile contributed 84% of revenue, accounting for $7.248bn which itself grew 51% to 8.8bn, resulting the net income of $3.5bn for the 4th quarter. Now, Facebook has 1.9bn users, 1.2bn logging on every day. From this it’s clear that Facebook has successfully completed its shift to mobile.

All of Facebook’s engagement and ad targeting is paying off. It reached a massive $19.81 average revenue per user in the U.S. and Canada, up 44 percent YoY. Globally, it hit $4.83 ARPU, up 29.5 percent YoY. That means it’s earning nearly $20 per user per year. The ability to squeeze more and more cash out of each user in its established Western markets, while steadily earning more in developing countries where it’s still growing, shows Facebook has strong earning potential for the foreseeable future.

Because of their earning potentiality Facebook has now become less cautious about newsfeed- with users seeing far more than one ad per day- but now they are planning to stop adding more by middle of this year.

Because of their earning potentiality Facebook has now become less cautious about newsfeed- with users seeing far more than one ad per day- but now they are planning to stop adding more by middle of this year.

It has plenty of options opened in front to increase revenue: win new users, which it did at 17% YoY though many from Asia and other areas which spend less on digital advertising increase the time users spend on the platform, and get more markets to buy more ads.

But it is also on the hunt for a new newsfeed, an area in Facebook’s Family of appa where it can put more ads. David Wehner, cheief financial officer, said there was a “bunch of places” where they could increase ad impressions.

“When you look at the texture of the business today, the bulk of the revenue and growth coming from Facebook, with Instagram increasingly making a contribution, and we’re experimenting with other services,” he said.

During the earnings call, CEO Mark Zuckerberg was repeatedly asked about Facebook’s video content strategy. He explained that “ We are focusing on shorter form content to start”, and that the company needs to build a sustainable ad revenue sharing business model to pay professional creators to bring that content to Facebook. Zuckerberg also noted video’s progress outside of content, citing that 400 million people use Facebook Messenger audio and video calling each Month.

“Video is a megatrend on the same order as mobile,” he said.

Facebook is now testing “mid-roll” ads in videos, such as advert breaks on TV, including in livestreams. Sheryl Sandberg, Facebook’s chief operating officer, said this is in the “early experimental stage” and the company is working with marketers to help them learn how to make better video ads.

Facebook had a tumultuous quarter in the news after it was hit with allegations that fake news that spread through its network helped Donald Trump get elected. Meanwhile, it was just hit today with a $500 million penalty for damages related to Oculus co-founder Palmer Luckey breaking an NDA with VR company ZeniMax.

But in the meantime, Instagram has shined, and continues expanding its ad offerings. Its Snapchat Stories clone Instagram Stories hit 150 million daily users just 5 months after launch.

Facebook is also experimenting with generating revenue from its messaging apps. After working with businesses to build a platform for them to communicate with customers on Facebook Messenger, it is now trialling adverts that appear between threads of messages with friends.

WhatsApp, the SMS-replacement app it bought in 2014 for $22bn, plans to introduce a service for businesses to issue messages such as fraud or delivery alerts to existing customers later this year, though Ms Aho-Williamson suggests that could be delayed by lawsuits in Europe contesting the company’s change in its privacy policy.

Joshua March, chief executive of Conversocial, a social customer service company that works with Facebook Messenger, said it was still figuring out how to bring companies into both messaging apps without pushing users to their many rivals.

“The thing everyone is waiting for is when does Facebook see the real monetisation around the messaging platforms,” he said. “Almost all of their monetisation is core product and Instagram and they have another 1bn users on messenger and another 1bn on WhatsApp.”

While Facebook figures out its next newsfeed, Brian Wieser, an analyst at Pivotal, is forecasting that Facebook’s revenue growth will slow in 2017, to a 36 per cent increase year-on-year.

But he is not concerned. “The level of growth we are forecasting is still significant considering that the industry is likely to grow at less than half of that pace.”

Now 13 years old, Facebook has shown remarkable stamina, keeping users happily sharing and Liking despite the shift to mobile and the advent of newer, more visual-focused social media platforms. As it expands deeper into chat with Messenger and WhatsApp, and virtual reality with Oculus, Facebook has a strong core business to rely on. And if it can use Instagram Stories and similar copycats in its other apps to ward off the threat of Snapchat, it could continue to dominate social media into the next decade.

Reference: Financial Times and Techcrunch

Also Read,